October 23, 2024

In terms of innovation, Slovenia lags behind the European average, which is also noticeable in the wood and furniture industry and other industries in the wood-value chain. The Slovenian Smart Specialization Strategy (2017) has identified the wood-value chain as an industry with large development capabilities. To realize this potential, it is necessary to better understand existing innovation activities and the reasons for the lack of innovation activities.

More than 90 percent of enterprises in this industry are micro-enterprises, i.e., enterprises with less than ten employees, which are not covered by innovation surveys. The official Community Innovation Survey, for example, includes only enterprises with ten or more employees. We know very little about the innovation activities of micro-enterprises, which has already been written about by some researchers (e.g. Roper and Hewitt-Dundas 2017). Therefore, at InnoRenew CoE, as part of the project Revitalisation of traditional industry: An open innovation framework for Slovenia’s furniture sector, we decided to conduct our own survey, which also includes micro-enterprises. We prepared a questionnaire based on selected questions from the above-mentioned official survey, and we also added some of our own.

In total, 294 enterprises whose main activity belongs to the wood-value chain participated in the survey. Contact information was found in the Bizi.si business register, and the following seven industries were selected: Forestry, Production of wood and wood products, Production of paper and paper products, Furniture production, Other (selected) production activities, Construction and wholesale of wood, construction materials and sanitary equipment. Data collection took place over eight months (from 15 February to 15 October 2019) based on a postal survey that enterprise representatives were able to complete on paper or online.

Two-thirds of the enterprises that participated in the survey introduced at least one new or significantly better product, service or organizational process in the three years from 2016 to 2018, which was covered by the questions. We also asked these enterprises who developed these products, and multiple answers were possible. Most enterprises only developed new products (81 %) and services (74 %), while process innovation was dominated by the answer that it was about an adaptation of a product originally developed by another enterprise or institution (81 %). The share of procedures developed by other enterprises or institutions was also higher (64 %).

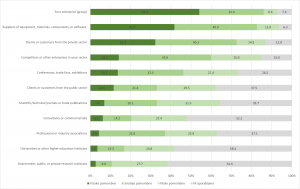

We then asked the enterprises that innovated about the sources of information that were most important to them. More than half of them mentioned sources from their enterprise or group of enterprises were very important (54 %). They were followed by suppliers (42 %) and private sector customers (32 %). The least important sources were universities and other educational institutions (4 %) and institutes, both public and private (3 %).

Figure 2: During the three years from 2016 to 2018, how important to your enterprise innovation activities were each of the following information sources? (n = 127)

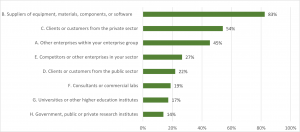

We were also interested in whether enterprises cooperated with the listed companies or institutions in any of their innovation activities. Most (83 %) cooperated with suppliers, followed by customers in the private sector (54 %) and then other enterprises in the group (45 %). As with information sources, the least cooperation was with higher education and research institutions.

Figure 3: During the three years from 2016 to 2018, did your enterprise cooperate on any of your innovation activities with other enterprises or organisations? (n = 127)

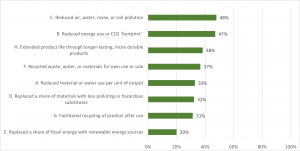

Next, we were interested, among other things, in whether product or process innovations and innovations in the field of organization or marketing had any of the listed environmental benefits. Almost half of the enterprises introduced innovations that reduced air, water, noise and soil pollution (48 %) or energy use (47 %). This was followed by innovations that bring extended product life (38 %) and recycling for own use or sale (37 %). Only one-third of enterprises (33 %) reduced the use of materials or water per unit of production and even fewer replaced materials with less polluting or hazardous materials (32 %) or facilitated the recycling of products after use (31 %). The least innovation was efforts to replace the share of fossil energy with renewable sources (20 %).

Figure 4: During the three years from 2016 to 2018, did your enterprise introduce a product, process, organisational or marketing innovation with any of the following environmental benefits? (n = 129)

The reason for the small number of innovations related to the environment is probably also the fact that the vast majority (93 %) of enterprises do not have procedures in place to regularly identify and reduce the company’s impact on the environment. We also asked them if they intended to introduce any of these innovations in the future, and most (17 %) chose to reduce their carbon footprint.

Summarizing the findings in this article (the results of the research are published in more detail in the research report), we can conclude that enterprises undertake innovation activities on their own and pay too little attention to sources of information such as higher education and research institutions, with which there is clearly only very little collaboration. Innovations with environmental benefits are also an untapped potential, but most enterprises do not intend to introduce them in the future. When enterprises were asked about the reasons for not innovating (in general), the majority (81 %) stated that there were no compelling reasons to innovate. Consideration should be given to encouraging companies to innovate more.

There are a number of methodological challenges associated with this type of research, which we presented in a contribution for the conference Applied Statistics 2019. In this contribution, we did a preliminary analysis of the relationship between company size and various indicators and calculated the bias of the official survey on innovation activities due to the exclusion of micro-enterprises. The latter differ most from small, medium and large enterprises in that they have less innovation in support activities for process innovation and that they have more service innovation.

In the future, the results should also be placed in the context of international comparisons, which we intend to do in the framework of a bilateral project, Innovation activities of Austrian and Slovenian companies in the wood-value chain.

Ana Slavec,

consulting statistician at InnoRenew CoE